- Floating LNG to Play Greater Role in Global Gas Development

Thursday, July 21, 2011

Rigzone Staff

by Karen Boman

While floating liquefaction technology has yet to be commercially proven, the success of floating liquefied natural gas (FLNG) could open previously stranded or non-commercial gas reserves worldwide.

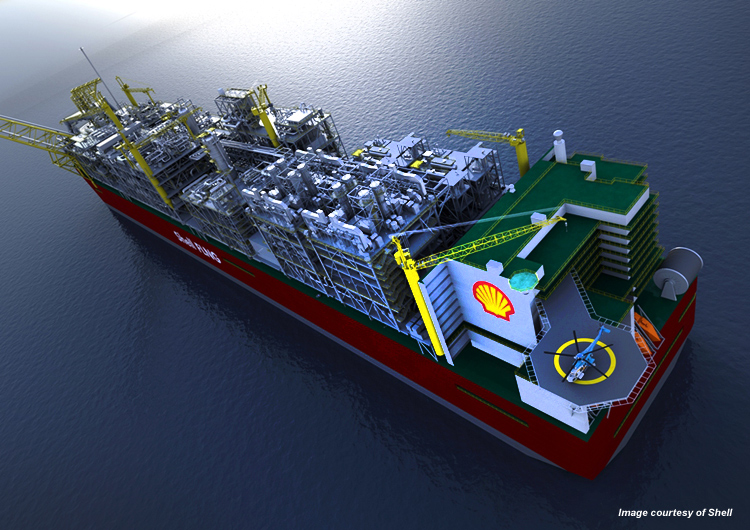

In May, Shell made the final investment decision to proceed with the development of its Prelude floating LNG project. Shell's Prelude facility, which will be deployed in the Browse Basin offshore Northwest Australia, will be the largest floating structure ever built.

While Shell's decision to push ahead with the Prelude project is a major breakthrough for FLNG liquefaction, the unit will not come on stream until the second half of the decade, said Douglas-Westwood analyst Lucy Miller. There are a number of other projects ongoing, but it's likely that these will also fall into this timeframe; no other projects have been approved. "On the whole, onshore developments are still favored; however, FLNG may prove to be more competitive in certain cases depending on the specific project's requirements.

"

Austral-Asia is seen as a key region for FLNG, particularly the Timor Sea offshore Australia and Papua New Guinea; other key areas include Southeast Asia and offshore Brazil, Miller said.

Douglas Westwood last year estimated that over $23 billion would be spent on FLNG development from 2010 to 2016, most of which will be spent on liquefaction facilities. During that time, Australia is expected to dominate the FLNG market with $5.3 billion in projects, followed by Africa with $5.2 billion in projects and Asia with $4.7 billion in projects. While North America has the greatest number of FLNG prospects, North American projects are expected to account for only seven percent of global expenditures from 2010 to 2016.

Douglas-Westwood views FLNG solutions as a solution for monetizing stranded gas assets that lie far offshore and distant to production infrastructure, addressing the security issues of onshore facilities and pipelines or boundary disputes such as the Timor Sea and South China Sea, and creating a market for gas that would normally be flared.

Accessing stranded gas reserves will be critical to meet the anticipated rise in global gas demand due to population and economic growth, particularly in emerging economies such as China. Douglas-Westwood notes that 6,531 Tcf of gas reserves remain worldwide; 3,000 Tcf of these reserves are considered stranded gas assets.

FLNG may allow Europe other gas supply options that could wean its dependence on Russian gas. More than 40 percent of the European Union's gas is imported -- about half of which comes from Russia – and imports are expected to rise to 75 percent by 2030. Europe's dependence on Russian imports makes it vulnerable to price hikes and supply cut-offs, as demonstrated when Gazprom doubled prices and cut supply going to the Ukraine, Lithuanian, Belarus and Georgia from 2006-2009.

FLNG import terminals are operating in Argentina, Brazil, Kuwait, the UK and the U.S. These include a mix of technological concepts such as regasification vessels and floating storage and regasification units. Some of the technologies involved in proposed FLNG projects have yet to be proven, Douglas-Westwood noted. Technical challenges facing FLNG development include development of sloshing-resistant containment systems; cryogenic offloading, side by side by loading arms or by tandem offloading; marinisation of liquefaction processing equipment; field specific and general topside modules; and the need to develop multiple small-scale or large-scale FLNG vessels, or vessels between 1 and 3 mmtpa and greater than 3 mmtpa.

Besides Shell, other companies seeking to develop liquefaction FLNG facilities include Flex LNG, Petrobras, SBM Offshore, Bluewater, Hoegh LNG, Excelerate Energy, ConocoPhillips and Sevan Marine are developing FLNG liquefaction design concepts, but no specific fields have been announced.

The anticipated start of operations on Flex LNG's FLNG project in Papua New Guinea (PNG) in 2014 is "perfect timing" for the anticipated wave of Asian LNG demand, Flex LNG reported earlier this year. Flex LNG in April entered agreements agreement with Interoil, Pacific LNG, Liquid Niugini Gas Ltd., and Samsung Heavy Industries for a FLNG project in PNG that would liquefy natural gas from the onshore Elk and Antelope gas fields in PNG's Gulf Province.

Samsung last month began field specific front-end engineering and design work (FEED) for the hull portion of the FLNG vessel. WorleyParsons and Kanfa Aragon will carry out the FEED work for the topsides. Samsung will remain responsible for the overall design, engineering, construction and commissioning of the FLNG vessel. FEED is set to be completed in time for the project to reach a Final Investment Decision before the end of this year, with operations in PNG targeted to begin in 2014.

FLEX LNG has already completed a generic FEED in 2009 and the field specific FEED will tailor the vessel for the PNG project where the FLNG vessel is expected to be moored alongside a jetty and have a nominal production capacity of close to 2 million tons of LNG per annum and to process an estimated 2.25 trillion cubic feet of gas over a firm 25-year period. The Elk and Antelope gas fields have substantial certified gas resources, with 6.5 Tcf of P90 resources and 8.6 Tcf and 10 Tcf in P50 and P10 estimates respectively.

Flex LNG reported that LNG projects are more costly than ever to develop, as the capital expenditures/ton of installed liquefaction capacity has made a permanent shift over the last decade from an average figure below 500USD/ton to typical range of 1,500-2,500 USD/ton. Due to the uniqueness of projects, current LNG development costs exceed the average cost for the oil and gas industry. Flex LNG anticipates that it will be in the lower end of the USD550-700 ton/liquefaction capacity CAPEX range for its PNG project.

Oil & Gas Post

Promote Your Page Too

LINK

Promote Your Page Too

LINK